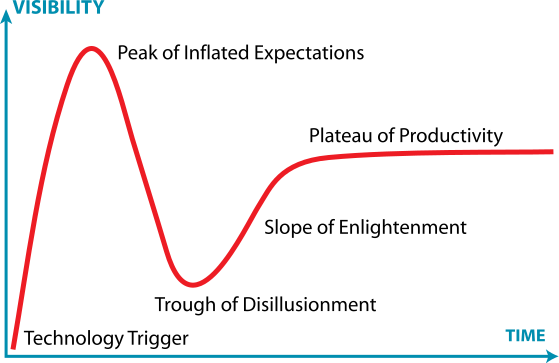

How do you grow a software business? What does growth look like?

This is what growth looks like. It starts slow, almost linear, from zero, and then (we hope) accelerates. The horizontal axis is time. The vertical axis is, well, whatever you want, to start with (users, sign-ups, click-through rate, leads…), but always has to end up being revenue, profit, cash generated.

The Lean Startup world generally begins with considering a minimum viable product. I’d like to suggest that this starts even sooner (like our chart), with a point, a data point: some single case where a customer says yes and pays for something. At that moment you have a single data point of one customer who has paid some amount for one product. You started with a hypothesis that someone would buy your product, and someone did. That is an existence proof … a customer exists. Now you have to see whether you can repeat, perhaps with some adjustments along the way. Can you find another customer, and then another who buy from you and seem to be buying the same product for more or less the same reason. If so, you have shown some amount of repeatability. It might be an ugly process, where you have to spend huge amounts of time and effort finding the customers, improving the product, but you know you’ve arrived when each subsequent customer takes less time and effort than the one before. You are even more sure when someone you hired is able to follow your play-book and make a sale themselves. You have reached repeatability… you have drawn a line from your original starting point. Somewhere in the journey so far you have found your minimum viable product.

The next quest is for scalability. Scaling can be (often is) dangerous. You have to repeat at accelerating speeds. When you do this, if the expense of adding a new customer is higher than the revenue (or near term revenue) you earn (or cash you collect), then you lose money at a faster and faster pace. The journey from point (existence proof) to line (repeatability) is hard. The journey on to the knee in the curve (scalability) is hard and dangerous. If you succeed, you are able to add profitable growth by some predictable amount with every dollar of new investment in sales and marketing (see SaaS Magic Number, for example).

Finally you ride scalability to scale, become a large and successful company and file for a $5b IPO.

I framed this journey from Existence Proof to Scale as one about sales, but it is mirrored again in your operations and customer service. Once you sell your product you have to actually provide it, support it, maintain it, renew it, upgrade it. You have to go through the same process of finding an existence proof (phew, the first customer is up and running) to repeatability (we have to hold their hands each time, but the play-book seems to cover most cases) to scalability (hey, it’s all automated) to scale (we are supporting four gazillion customers around the globe, each costing pennies to deploy and support). Of course you have to embark on both these journeys in parallel, and profitability is about revenue covering the cost of both of these (and a few other things besides).

That’s not all. To even start on sales you had to get going on the same journey in software development (existence proof = proof of concept), minimum viable product (self-explanatory), repeatability (a process that allows for rapid implementation of new features and bug fixes), scalability (reliable product management, continuous deployment, scalable reliable operation) and then to scale (five 9’s reliability). The same goes for hiring: can you hire one good person and keep them? how about a few? how about keeping up with a scaling sales effort? how about maintaining a large global workforce and a healthy, vibrant corporate culture?

Each step on each path is worth its own blog post or its own book. Each journey is a book or a shelf of books. Each company growth curve chart is a complex history of hard, hard work, all to go from point, to line, to curve.

I was recently asked to contribute to a series of articles for the Scalable Startups project at UC Berkeley. The first of my articles is now up and available for reading.

I was recently asked to contribute to a series of articles for the Scalable Startups project at UC Berkeley. The first of my articles is now up and available for reading.