Falling off a bike, especially when you can't get out of your clipless pedals when stopping, is embarrassing and may cause some scrapes. A failed investment generally involves the loss of several million dollars. This is where the American (or Anglo Saxon) approach to entrepreneurship shines. By seeing failure as an opportunity to learn, and by actually embracing failure, more risks are taken and more rewards are reaped. Fear of failing stifles new ideas since new ideas, by definition, may or may not succeed. The Venture Capital industry in the USA is built on the willingness of both entrepreneurs and investors to take risks, and the friendlier responses to failure enshrined here in law, regulation and culture.

In terms of learning from failure, Brad Feld has been running an occasional series about failure on his blog. His articles are well worth reading.

It is more than a friendly response to failure, or learning from failure, that stands out, however. VC's actively embrace failure. Why do VC's actively embrace failure, when venture cyclists try their hardest to avoid falling?

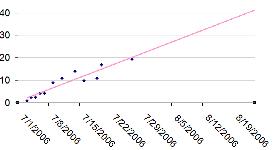

In early-stage investing (and this may be true in other types of investing, I am just not familiar with any other stage), a portfolio which does not have a few failures is unlikely to deliver industry leading returns. If a VC firm is so conservative as to only back companies which are very unlikely to fail, then they must be "sure bets", and so the price to invest will likely preclude the opportunity for a 10-bagger. We choose to invest in less certain outcomes, and so we seek less popular opportunities. With fewer investors chasing the deal, the shares are cheaper, and the potential reward is proportionally larger. If my $4m investment buys 50% of a company, selling it a few years later for a high price brings much higher rewards than if my original $4m only buys 10% of the company.

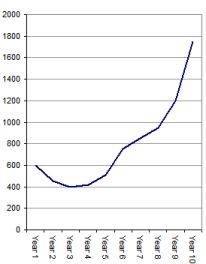

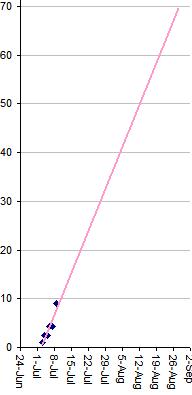

This is, in a sense, the underlying reason that VC funds experience a J-curve. We could avoid a J-curve by avoiding investments that might fail, but then we would be avoiding the higher returns we are supposed to be generating. VC funds track their capital loss ratio (the percent of a fund that is lost in failed investments). No one wants a high ratio, but anything approaching zero is not a good predictor of high returns either.

Of course, each deal we do always starts off as a potential 10-bagger; why else would we invest? We just know that over time some will fail, and that is to be expected. We don't seek failure, but we know that to do our job well, we are likely to experience it from time to time.

In a final note, I suppose one could say venture cyclists also embrace failure. I am about to start using clipless pedals, which increases the possibility of a scrape. Why? It is because I can exert extra power pulling as well as pushing on the pedals (using the complete rotation of the pedals on each leg to impart energy to the bike), and I can reduce the energy I use to keep my feet on the pedals (fighting gravity, especially on a recumbent). I am not seeking failure, or desiring failure, but I understand the upside that I do seek brings with it the chance of a fall.

As we rode, we noted lots of pretty views especially in the Lexington and Bedford stretches. There were several meadows of beautiful purple wild flowers. I mentioned to Gregg that something this dominant in the scenery is probably an invasive species. I entered

As we rode, we noted lots of pretty views especially in the Lexington and Bedford stretches. There were several meadows of beautiful purple wild flowers. I mentioned to Gregg that something this dominant in the scenery is probably an invasive species. I entered  First I tried the Solo Chocolate Charger “low glycemic nutrition bar”.

First I tried the Solo Chocolate Charger “low glycemic nutrition bar”. Second I tried the Pria Double Chocolate Cookie bar (from PowerBar).

Second I tried the Pria Double Chocolate Cookie bar (from PowerBar). Next was the awful GoLean Malted Chocolate Crisp bar (from Kashi).

Next was the awful GoLean Malted Chocolate Crisp bar (from Kashi).

I am now the proud owner of a recumbent bicycle. To be more precise, I am the proud owner of a

I am now the proud owner of a recumbent bicycle. To be more precise, I am the proud owner of a